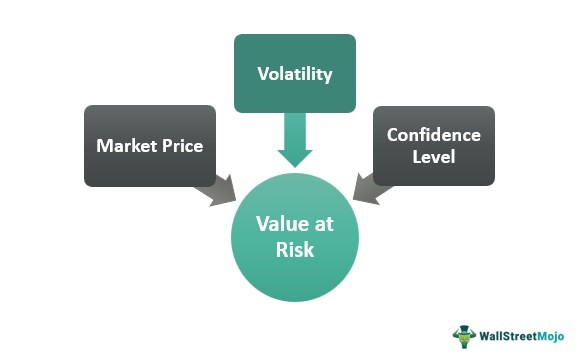

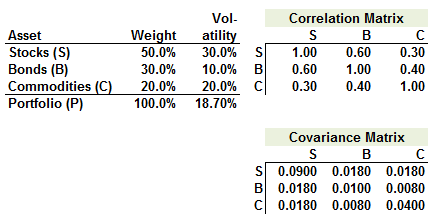

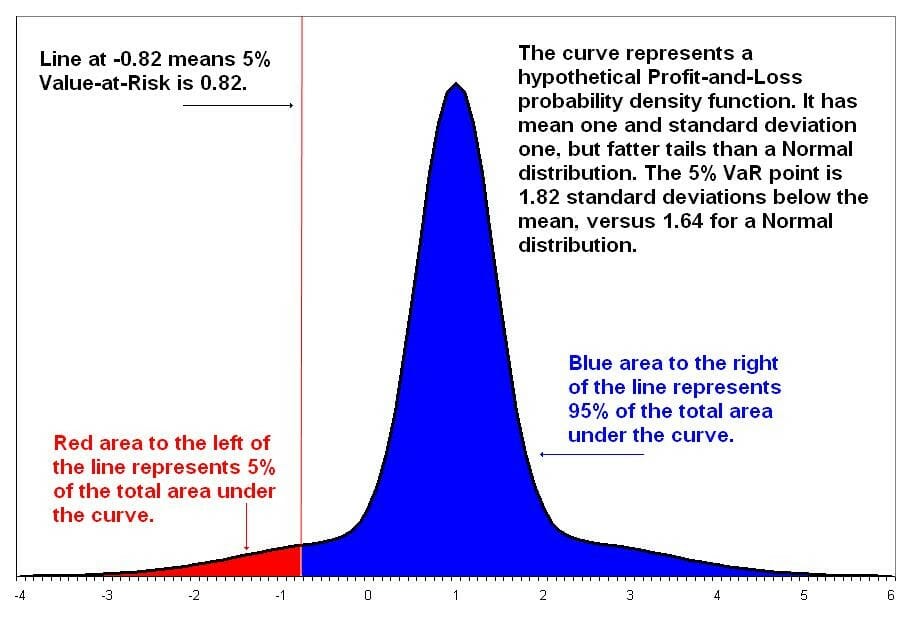

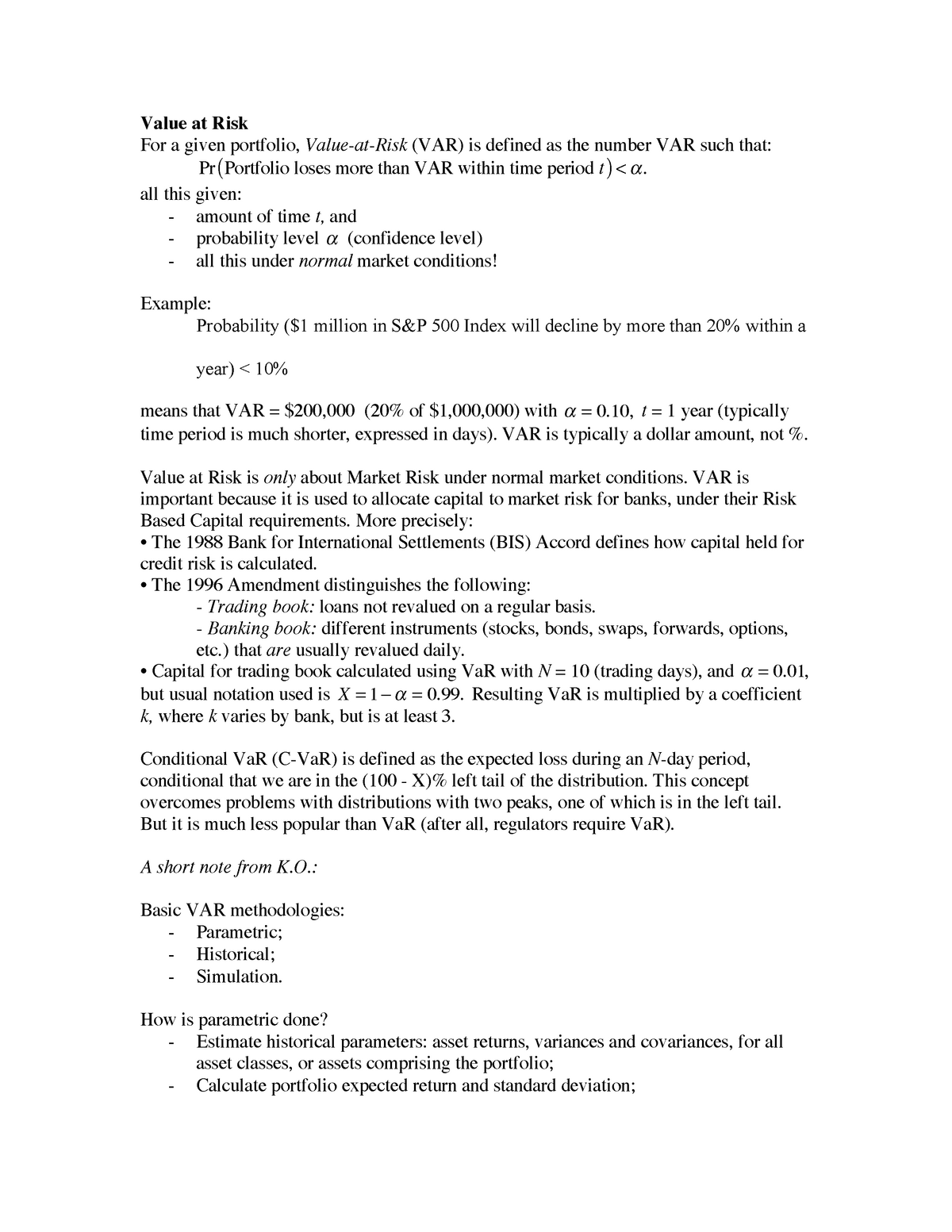

In the calculation of value at risk (VaR), what happens to the VaR when the confidence level is changed? What are other factors affecting VaR? - Quora

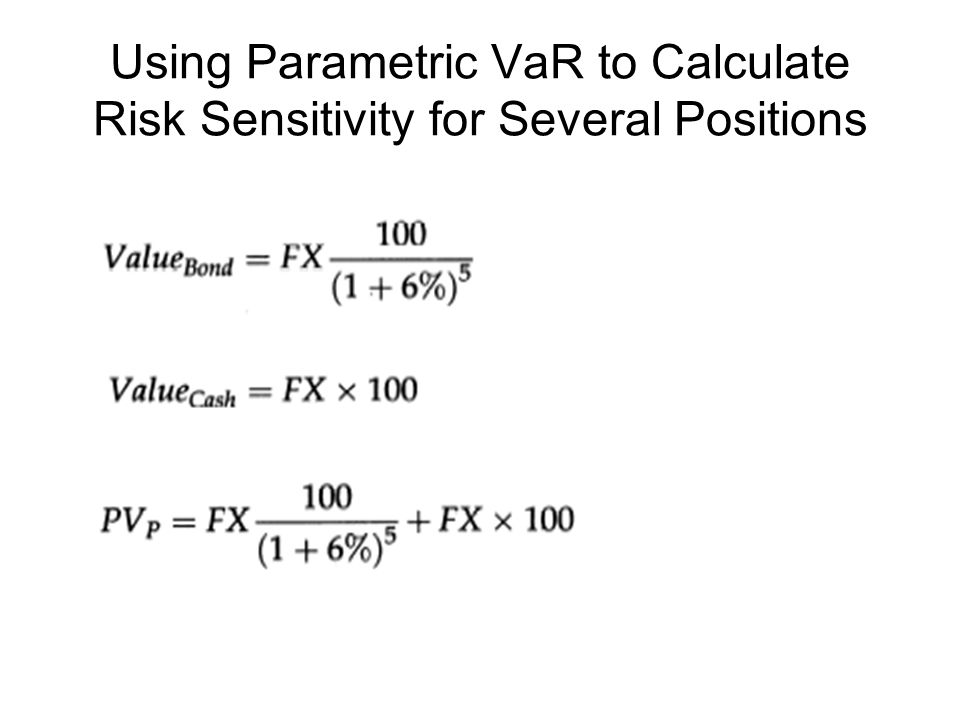

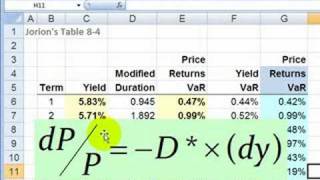

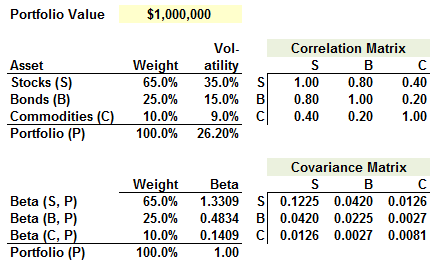

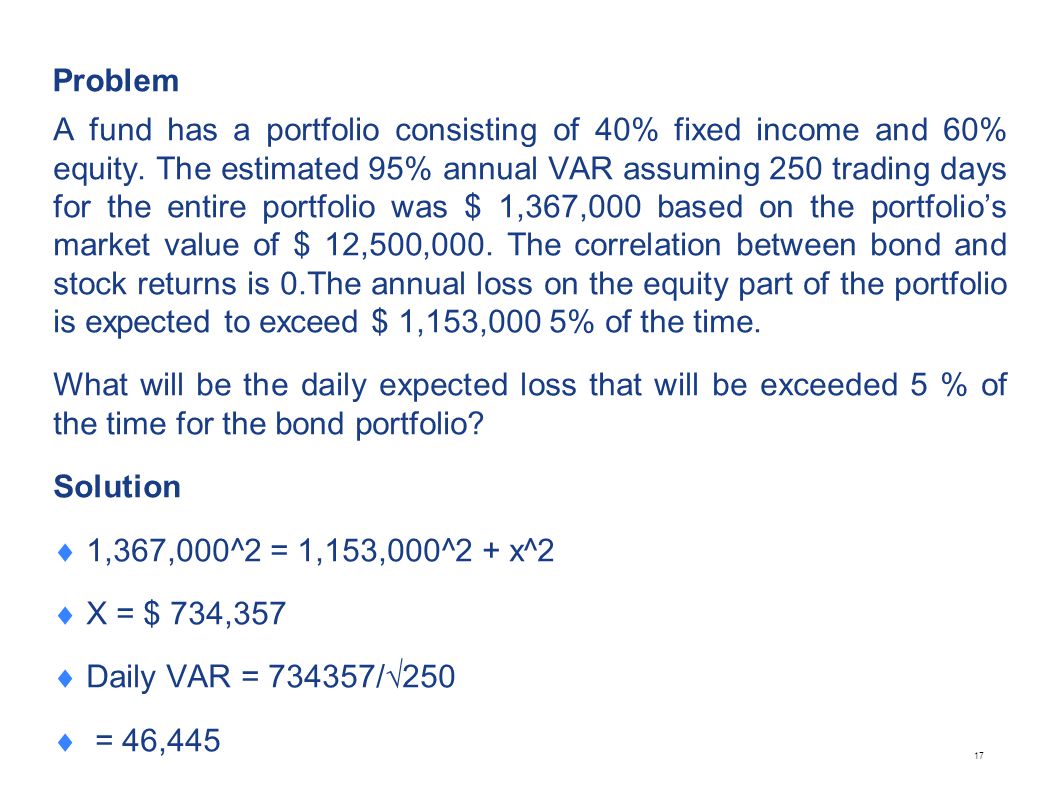

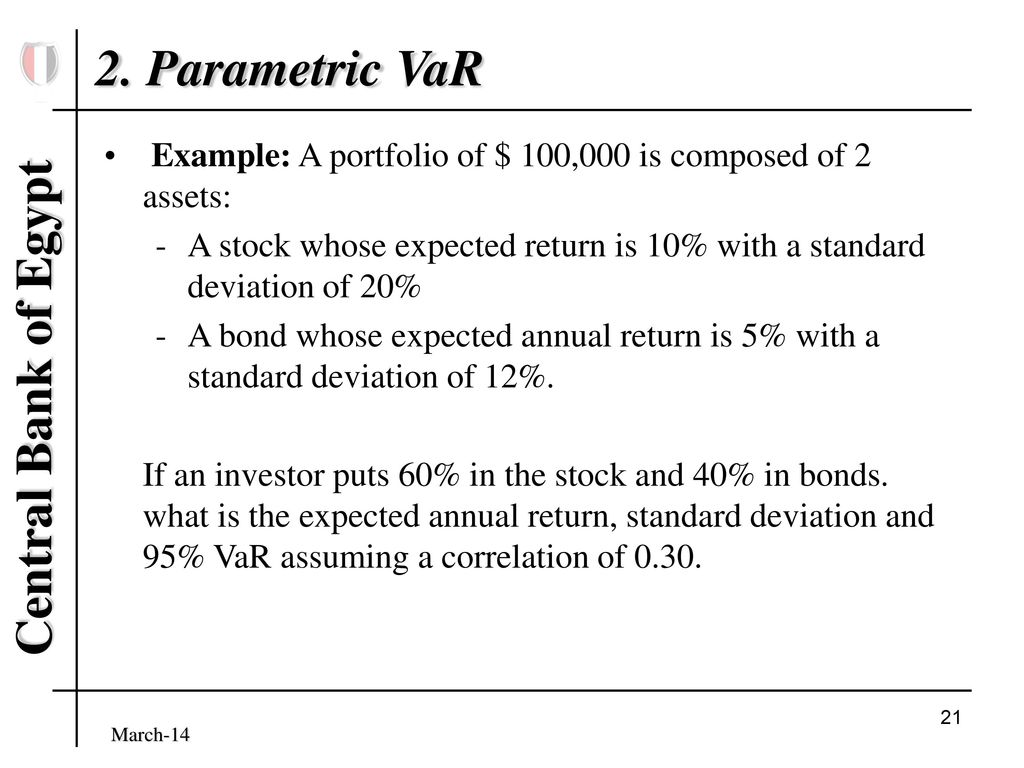

Introduction VAR tells us the maximum loss a portfolio may suffer at a given confidence interval for a specified time horizon. If we can be 95% sure that. - ppt download

:max_bytes(150000):strip_icc()/Variance-CovarianceMethod5-5bde86ce7819405ca63f26aa275a4bd2.png)