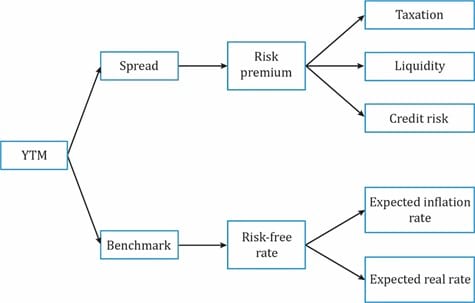

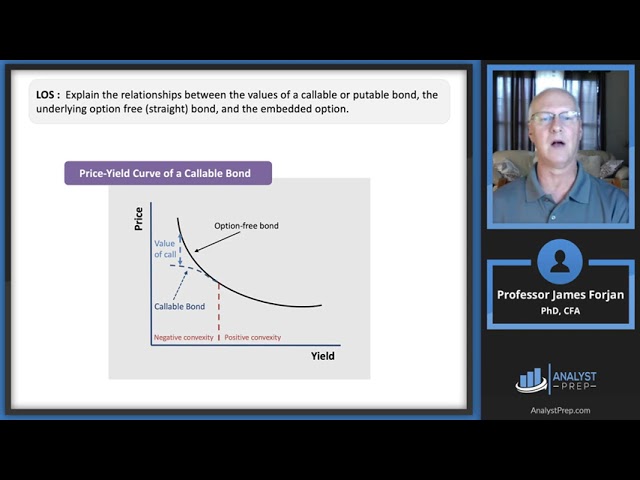

CFA Tutorial: Fixed Income (Option Adjusted Spread (OAS) and Z-spread for Option Embedded Bonds) - YouTube

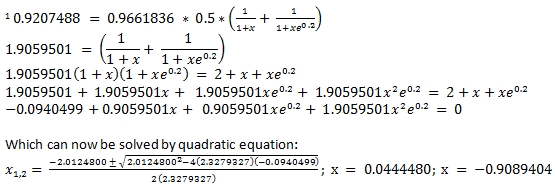

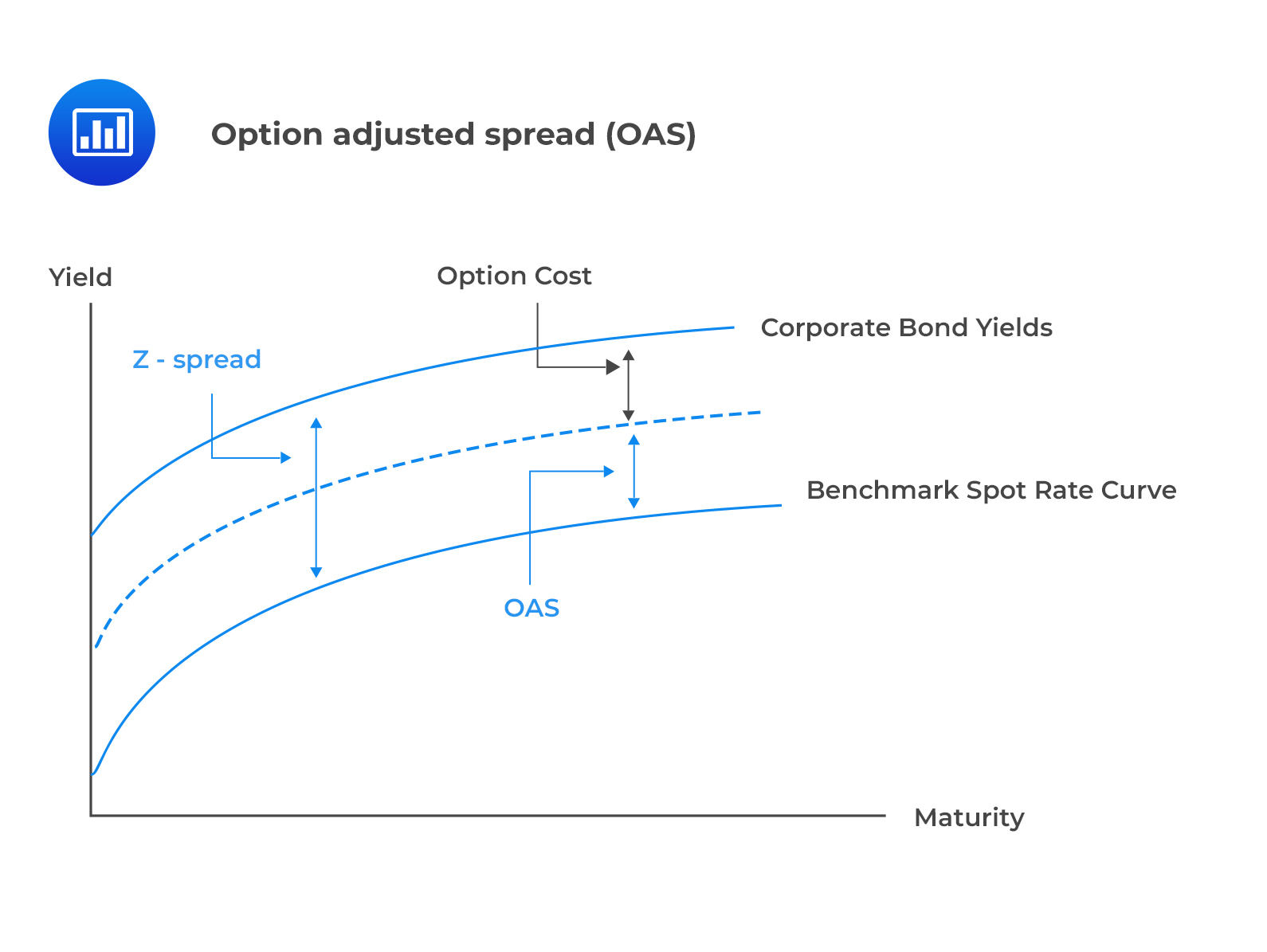

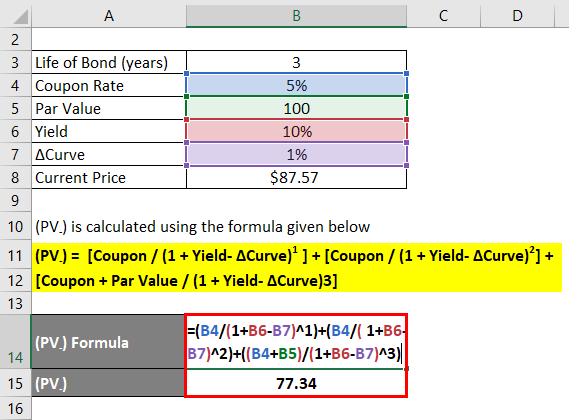

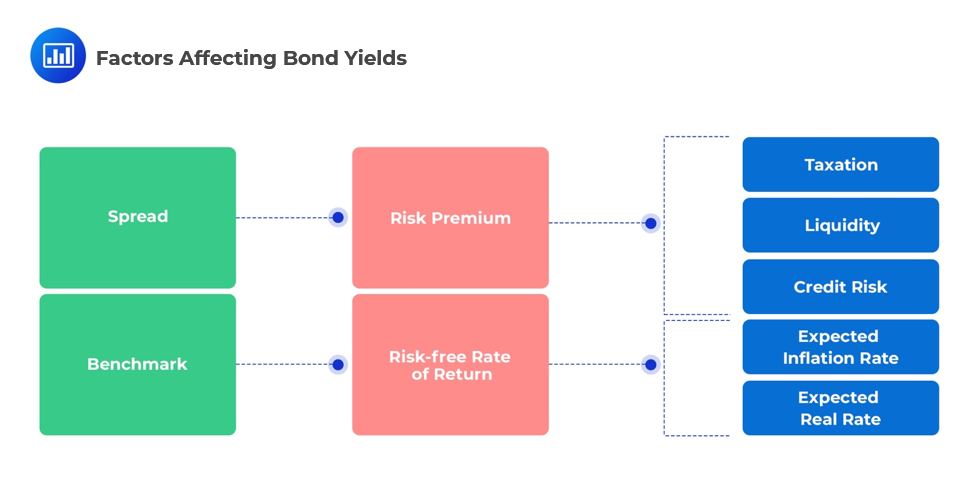

Callable Bonds Professor Anh Le. 0 – Plan 1.Callable bonds – what and why? 2.Yields to call, worst 3.Valuation 4.Spread due to optionality 5.Z-spread. - ppt download