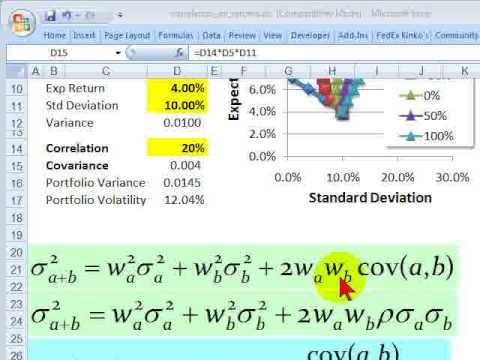

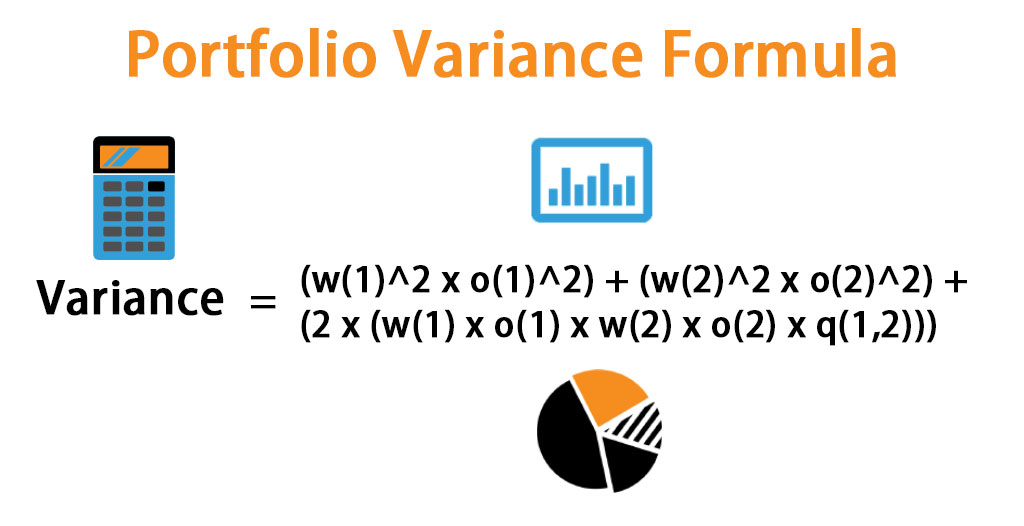

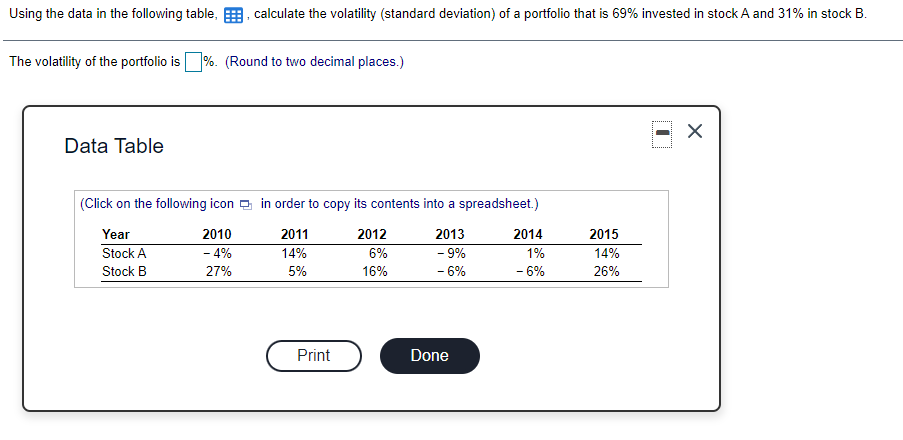

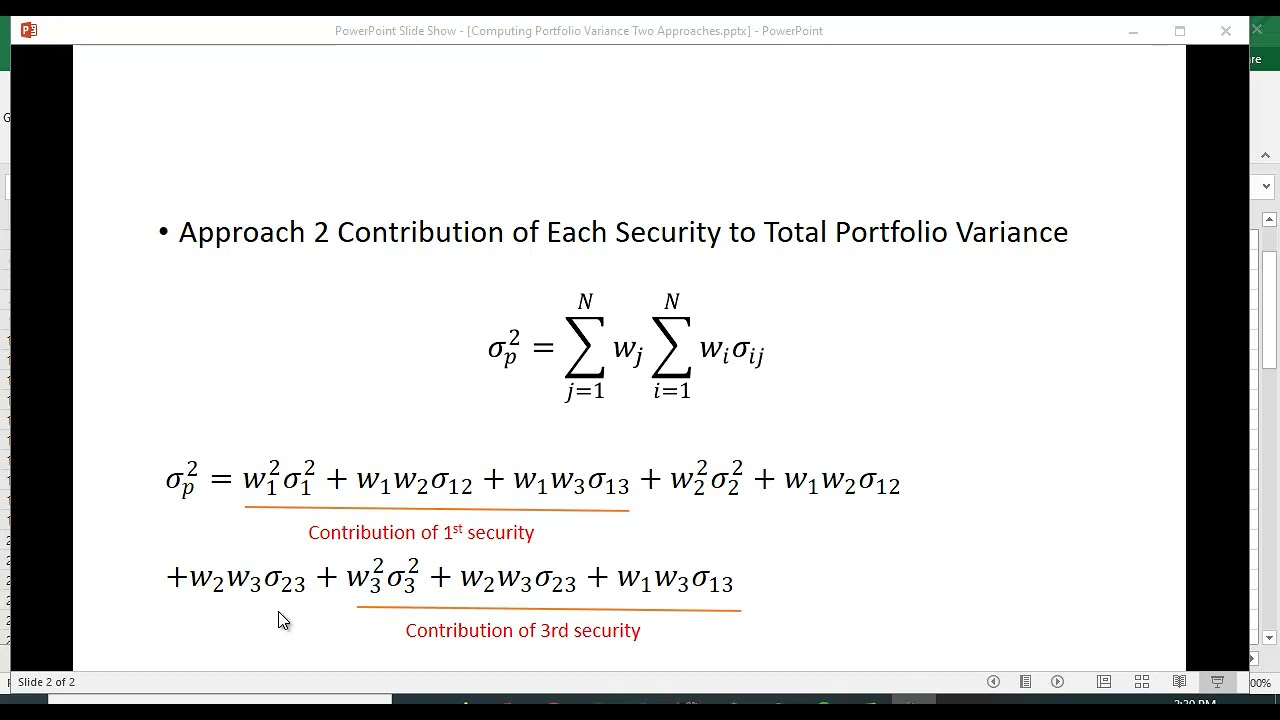

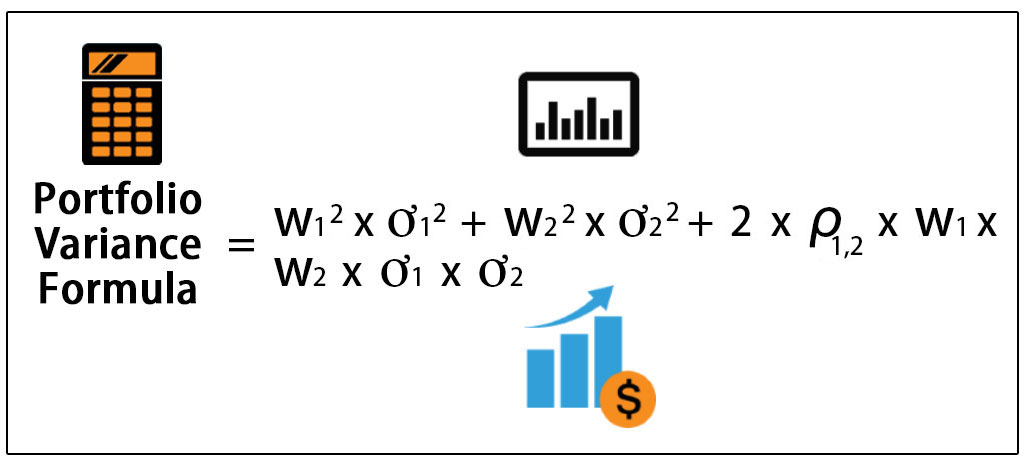

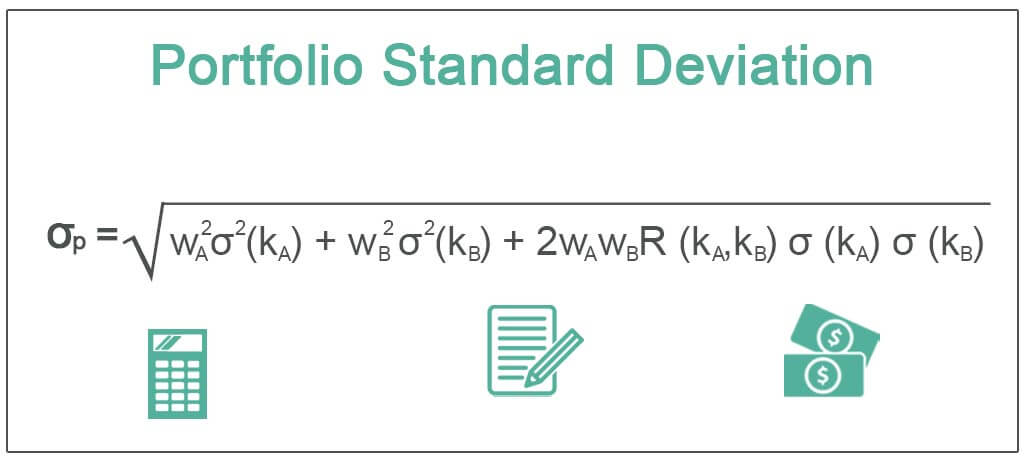

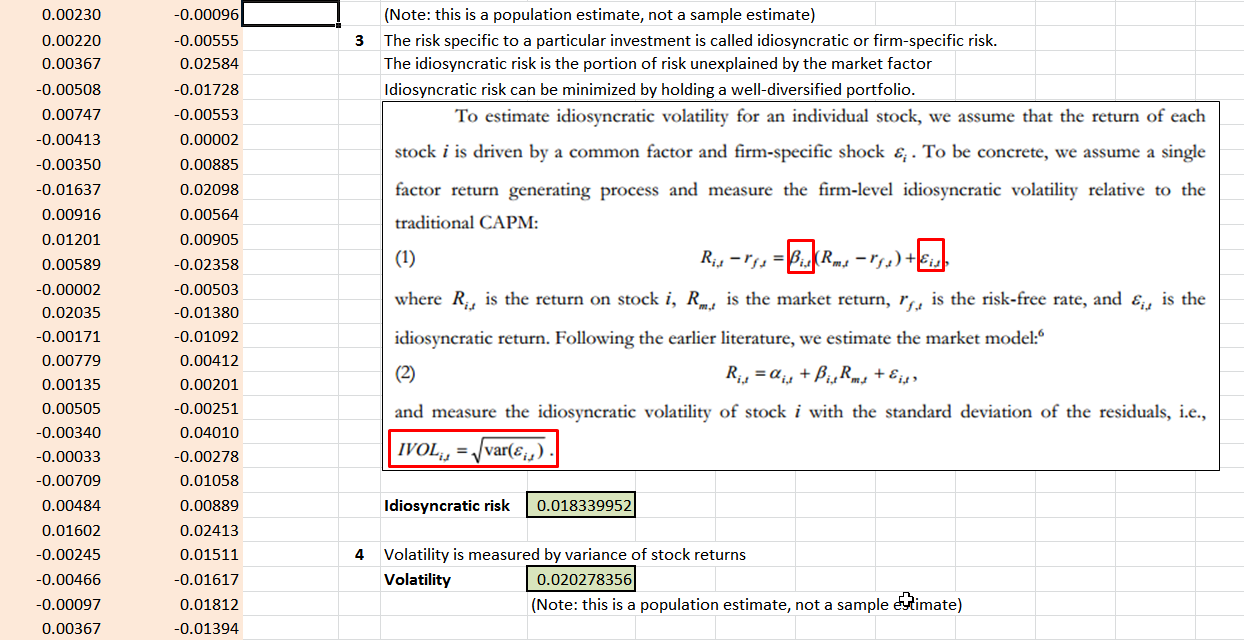

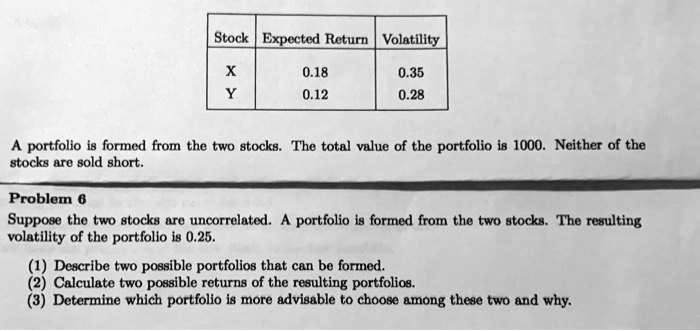

SOLVED: Stock Expected Return Volatility 0.18 0.12 0.35 0.28 portfolio is formed from the two stocks The total value of the portfolio is 10O0. Neither of the stocks aro sold short Problom

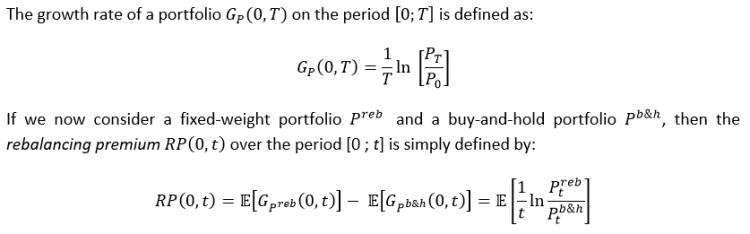

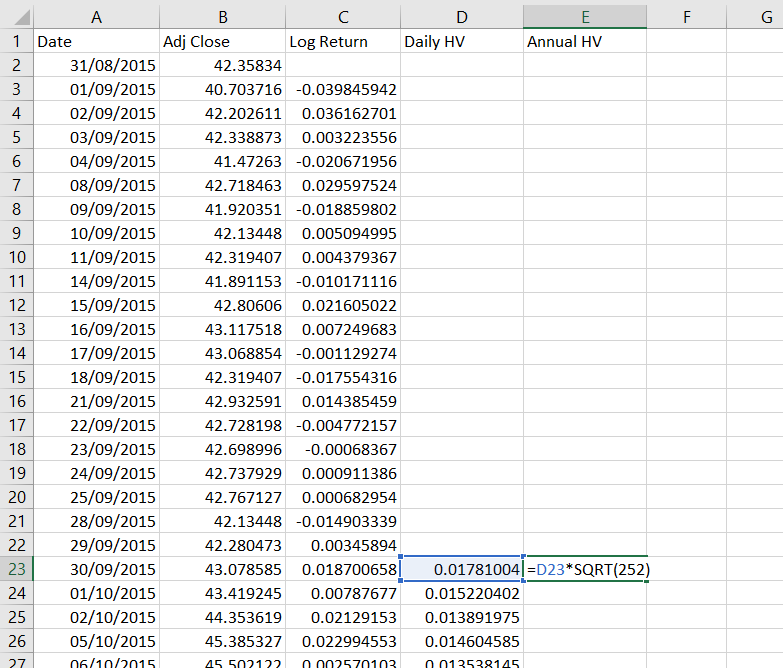

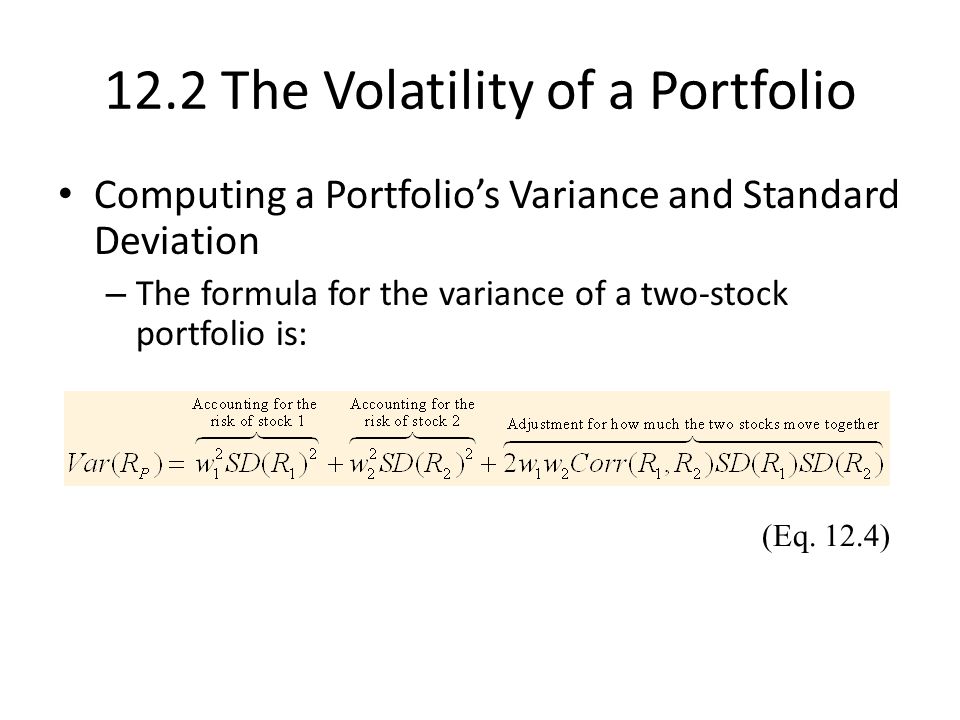

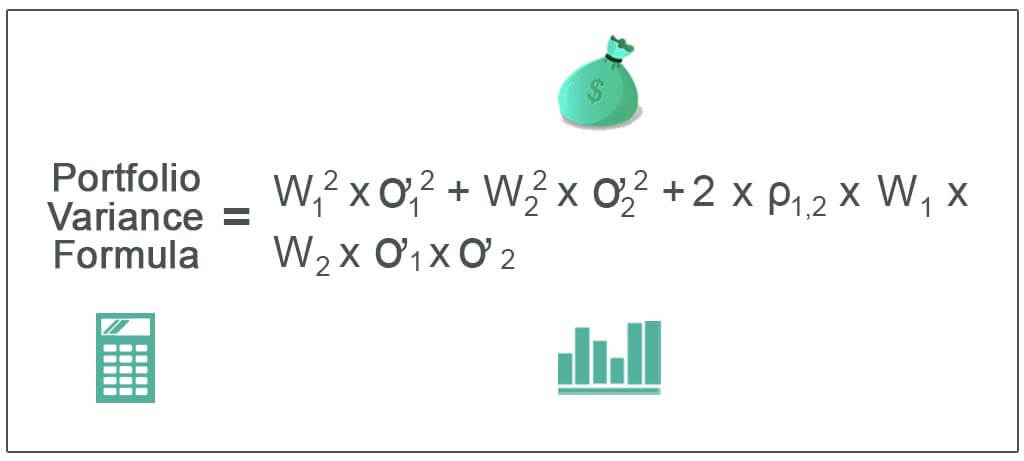

I have volatility of a portfolio in year 1 and in year 2. How do I calculate the volatility over the total 2-year period? - Quantitative Finance Stack Exchange