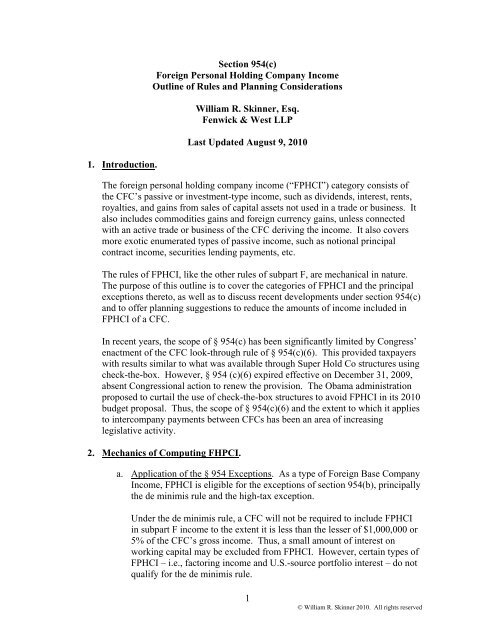

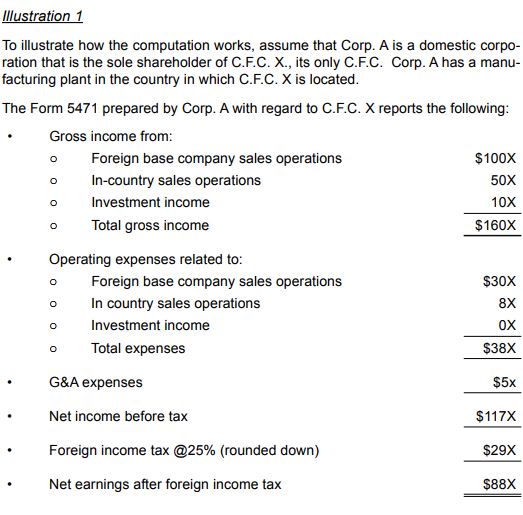

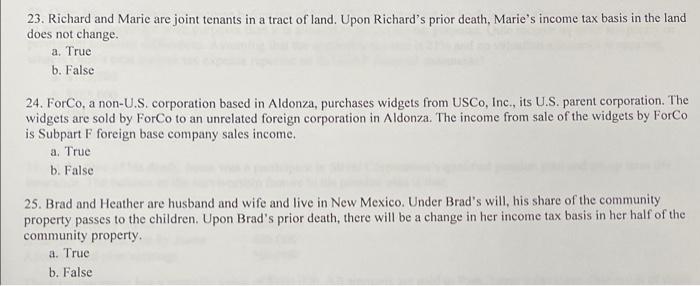

Page 2063 TITLE 26—INTERNAL REVENUE CODE § 954 § 954. Foreign base company income (a) Foreign base company income For purpos

What does FBCSI mean? - Definition of FBCSI - FBCSI stands for Foreign Base Company Sales Income. By AcronymsAndSlang.com

Speaker] This event is being recorded and will be available for playback. Please select the green check mark to confirm you un

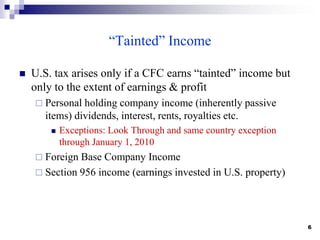

The Accidental Taxpayer Tax Tips for Crossing Borders in Business and in Life Presented by Meril Markley International Tax Principal Houston Business and. - ppt download

Speaker] This event is being recorded and will be available for playback. Please select the green check mark to confirm you un