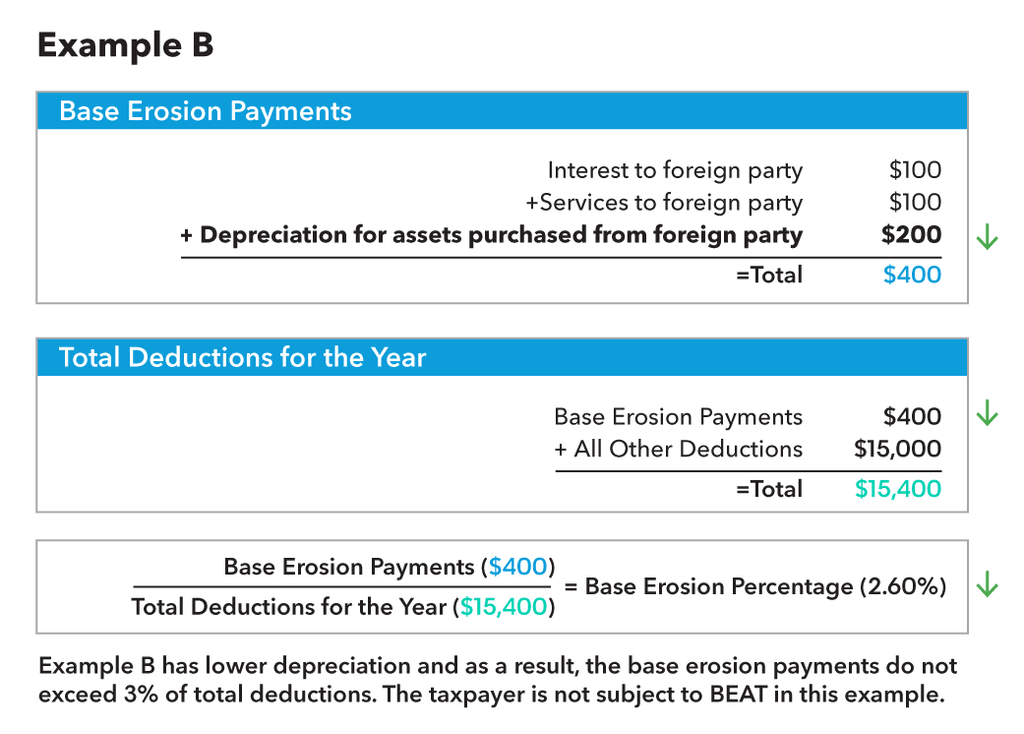

For the Record : Newsletter from Andersen : Q1 2018 Newsletter : Transfer Pricing Update: Surveying the Landscape of the New Base Erosion Rules

Base Erosion and Profit Shifting ((BEPS) | Deloitte | Tax Services | International Tax |Insights | Article

What are Illicit Financial Flows and Base Erosion and Profit Shifting - AIDC | Alternative Information & Development Centre

OECD/G20 Base Erosion and Profit Shifting Project Limiting Base Erosion Involving Interest Deduction by

Action Plan On Base Erosion And Profit Shifting: Organization for Economic Cooperation and Development: 9789264202702: Amazon.com: Books

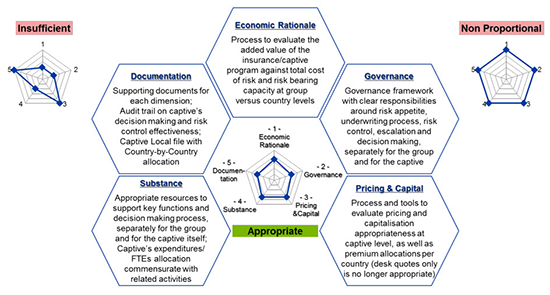

The Base Erosion & Profit Shifting project: A fundamental change to the taxation of international companies

Tax Base Erosion and Profit Shifting in Africa – Part 1: Africa's Response to the OECD BEPS Action Plan – ICTD